Date: April 12, 2021

- First in a series of five workshops titled ‘VAT Registration in Oman’

- Conducted in partnership with OMINVEST and execution by Moore

- Next workshop will be focused on ‘Basic Concepts And Tax Implications On Key Business Transaction’.

Zubair Small Enterprises Centre (Zubair SEC), in partnership with the Omani International Development and Investment Company (OMINVEST), has successfully completed the first of five webinars of their recently launched ‘Know Your VAT’ initiative executed by Moore.

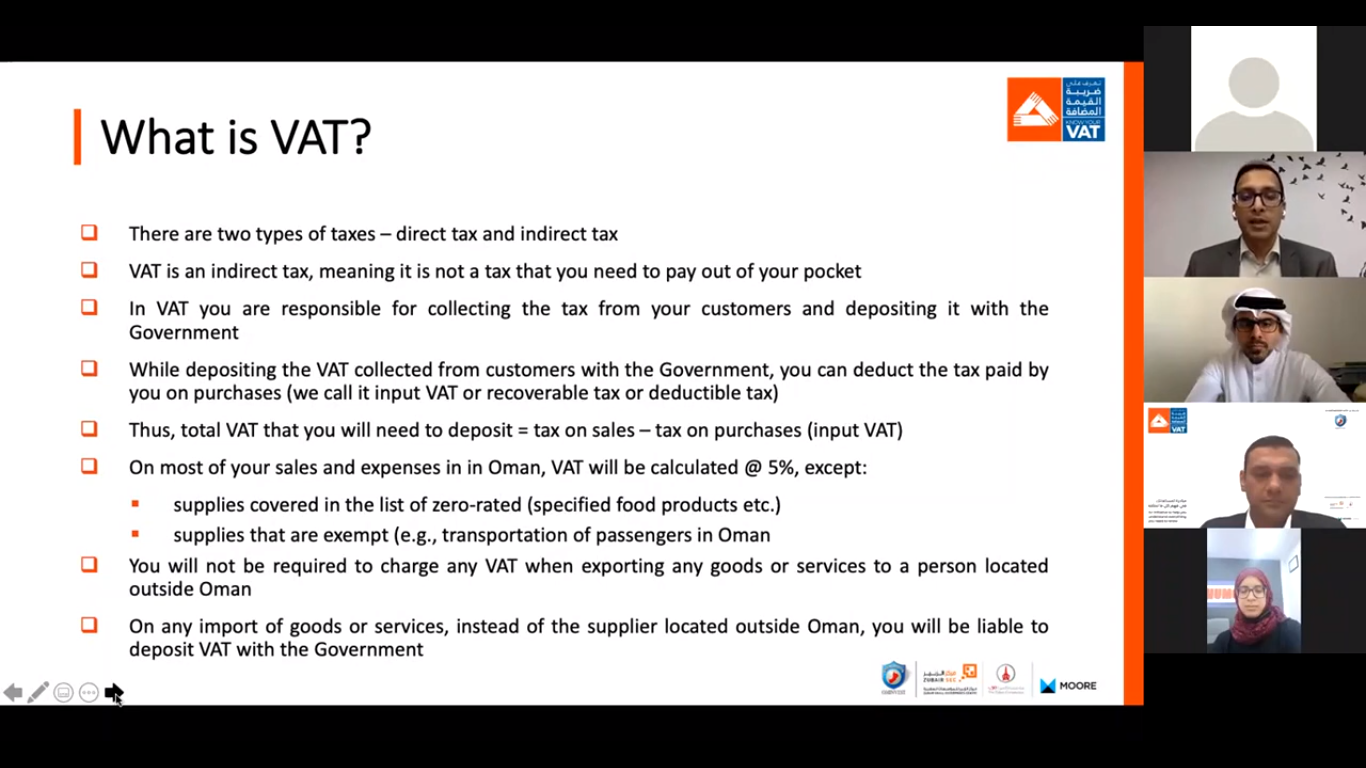

The Sultanate will be implementing the Value-Added Tax (VAT) law as of April 16. The law applies to any company whose taxable turnover exceeds OMR 38,500, which includes the majority of Small and Medium Enterprises (SMEs).

Commenting on the ‘Know Your VAT’ initiative, Ali Shaker – Advisor-BD and strategic partnership at Zubair SEC said, “At Zubair SEC, we are very glad to have kickstarted this program now, which is a very crucial time for SMEs as the VAT law is just starting to be implemented in Oman. It will help our SME members meet all the required steps and procedures to properly prepare themselves for the VAT implementation and as a result, avoid any risks and implications from being ill prepared.”

The initiative, which is considered the first of its kind from the private sector to cover new VAT laws and procedures, was launched earlier in the month with the aim of helping SMEs prepare themselves and ensure their businesses comply with the upcoming VAT requirements. It includes a series of five webinars, five short animated videos, a digital downloadable booklet, and one-to-one sessions where required.

This was the first of the five webinars, titled ‘VAT Registration in Oman’, and was conducted on April 12 covering three core topics – understanding VAT, who is required to register under VAT, and the registration process for those with and without a Commercial Registration Number (CRN). In addition, the session also included other valuable information concerning the registration process. It was attended by over 50 Zubair SEC members, each of whom were very appreciative of the webinar, commending the organisers for keeping it thoroughly interactive and engaging.

Zubair SEC member, Ahmed Al Shabibi said, “We really appreciate the workshop and the importance of the topic, VAT for SMEs, and understanding the required steps for VAT registration is very crucial at this stage. It helps us to be well prepared before the enforcement date.”

Ebtisam Al Maskari, another member of Zubair SEC added, “At the end of the webinar I had a clear idea and a good understanding about VAT. This gave me the confidence I needed in deciding to register and prepare for it, following the points that had been suggested in the webinar.”

Both members expressed their gratitude to Zubair SEC and Ominvest for arranging for such webinar. “Giving us the opportunity to have a Q&A session with VAT experts duting the final portion of the webinar was very helpful and interactive. Many participants had questions and concerns, all of which were cleared and answered,” added Ebtisam Al Maskari.

“We would like to offer our sincere thanks to OMINVEST for making this initiative possible. We look forward to hosting the next webinar soon and would like to invite all interested SMEs to register at the earliest so as to benefit from the program,” said Ali Shaker. The next ‘Know Your VAT’ webinar will be focused on ‘Basic Concepts And Tax Implications On Key Business Transaction’. Those SMEs interested in participating can contact Zubair SEC via email: info@zubairsec.org, or telephone: 24737325.